Better solutions for your

financial needs

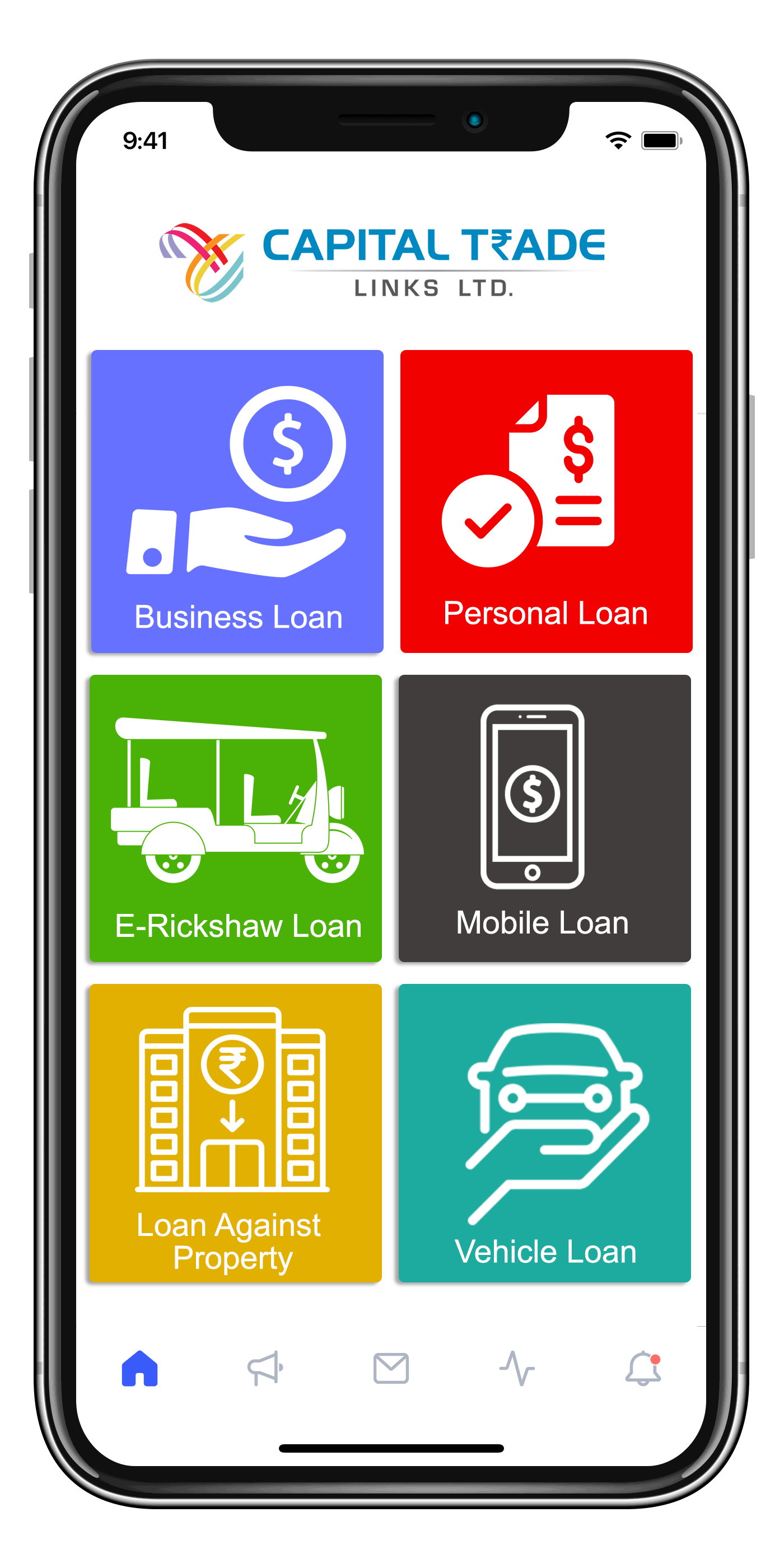

100% Online Application

Quick Loan Processing

WHY CHOOSE US?

APPLY ANYTIME, ANYWHERE

You can apply your loan from anywhere using Fintech Partners App. Fill the required fields and upload the documents in just a few minutes.

FAST APPROVALS

Our credit team reviews the application, If your documents are as per requirement we will approve the application.

QUICK DISBURSALS

Once Application get approved Loan Amont Will be Disbused to your Bank Account on Same day.

WHAT WE OFFERS

Business Loan

When business expansion opportunities or the possibilities of a new business idea arise, you have the power to take immediate advantage of them with CTL...

E-Rickshaw Loan

Capital Trade offers you the best E-Rickshaw loans, along with attractive interest rates and tenure of up to 24 Month.

Loan Against Property

Capital Trade offers loan against property for fulfilling personal needs such as meeting expenditure on education, marriage, healthcare etc.

Personal Loan

Personal Loan is associated to unsecured loan for private use that doesn't need any security or collateral and can be availed for any purpose...

Mobile Loan

Capital Trade offers mobile loan for buying a mobile phone worth up to 1 lakh. You can avail mobile loan for up to 3-12 months.

Vehicle Loan

Make your dream of owning a car a reality with the Capital Trade Vehicle Loan, Offering attractive interest rates.

Features And Benefits

Same Day Loan Decisions.

Same Day Loan Decisions. Apply the Same Day You Join.

Apply the Same Day You Join. Maximum loan amount for purchase of property.

Maximum loan amount for purchase of property. Higher loan eligibility.

Higher loan eligibility. We cater to the needs of all segments - Salaried, Self Employed.

We cater to the needs of all segments - Salaried, Self Employed. Flexibility of loan tenor

Flexibility of loan tenor

Latest news.

What clients say.

This is an amazing personal loan app. Very customer-friendly service and quick response time. The team update me on every process and steps of loan processing. This expedited the process and gave me confidence.

Capital Trade is an excellent app. I got my loan approved in one day itself. We just have to complete all the procedures correctly, and submit our correct bank account details. It is very useful.

My experience borrowing with CapitalTrade was too good. Their customer service team is great, and they really helped me a lot whenever I needed it.

I recommend this app 100% to everyone who needs emergency funds. Believe it or not, after applying and providing my details, my loan got credited within 5 minutes into my bank account! I give CapitalTrade 5 stars. Download the app and see for yourself!